You often hear angel investing is more art than science, but what happens when you combine the art with the science.

The VC and angel investing process, in my opinion, is somewhat broken (inefficient being the better word).

My first point is pretty obvious, but people aren’t venture capital funds. The main difference between the way a VC will invest and the way an angel will invest is largely to do with opportunity cost. VCs will often have 100s of millions for the sole purpose of investing in private companies, so they are naturally in a position to diversify and spread risks across a large number of companies whilst the average angel investor is more likely to take a larger amount of risk on a smaller size portfolio.

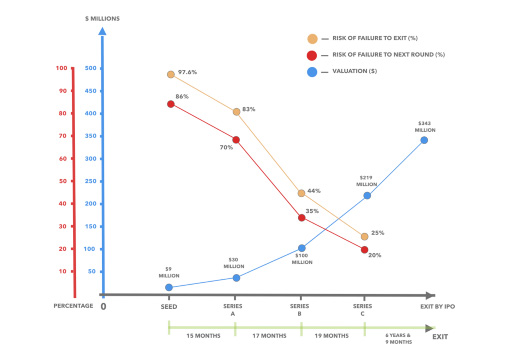

This risk is amplified by the fact that most angels will invest at the seed/pre-seed stage as this is often the stage at which the opportunity is presented to them (with an average chance for a successful exit at 2.4%). In other words, when investing at these stages, you will need to, on average, invest in 42 companies, to result in one exit. Which brings me nicely on to my next point, exits.

I find the concept of exits really interesting, largely due to its effect on liquidity coupled with the level of risk to reward. For example, investing in X company at seed stage may mean you 40x your money (based on the average seed valuation amount of $9 million and the average IPO 2020 valuation of $353m) but this, however, comes with an average of 11 years to realise your returns.

The problem here is diversifying to this extent will inevitably reduce returns. For example, as mentioned above, you would need to invest in an average of 42 companies to adequately cover the risk of investing at seed stage.

So taking 42 companies and an investment amount of £5,000 across each will mean investing around £119 in each company on a primary fund raise. Assuming this plays out (ignoring minimum investment amounts, etc…), our investments will have made a return of 40x (assuming the average seed ($9m) and exit ($343m) valuation) over an 11 year period totalling £4,760. In other words, adequately diversifying your portfolio would mean you would end up with a loss.

However, if I were to break down the graph as a somewhat risk averse person, I personally like the odds presented to me from investing via a secondary transaction from Series B to Series C, where there is a median success rate of 72.5% with an average increase in valuation of 2X.

So what happens if we could rinse and repeat the process of investing at Series B and exiting through a secondary at Series C, over the similar period of seed to exit?

Starting with the same £5,000 mentioned above, I would diversify £1,000 into 5 companies (in the first instance) and would expect a median 72.5% success rate, meaning that we could reasonably expect 3 companies to go on to exit. Here’s how this would pan out over a similar time period:

This would produce a total of £50,600, roughly £45,000 more than the traditional model of waiting to exit explored above, with the added benefits of less risk and more liquidity. Now of course this isn’t perfect, but the theory leaves you much better off.

Right now you might be saying, “but Emmanuel, this is all good and well, but where will you find a constant stream of people willing to sell at Series B and buy at Series C?”

My answer is somewhat varied but involves 3 different points:

- Reasons for investing — People have different reasons for investing e.g. seed investor may invest to provided added expertise and value at the seed stage of the company and are subsequently looking to offload and reinvest in another startup to do the same.

- Risk appetite to reward — another investor may have a different risk to reward appetite and may want to invest at Series A and exit at Series B, repeating this process in a similar way.

- Life — an investor may find themselves in a situation where they need to access capital.

Whilst heavily based on theory, this pretty much summarises the reason why I decided to create Incept, a decentralised secondary market for the sale and purchase of private equity:

- for Angels, investing at a higher risk due to the limited ability to diversify adequately, coupled with the lack of liquidity means startup investing is unlikely to produce adequate results; and

- for VCs, I just don’t think the model is as effective as it could be.