A secondary stock transaction occurs when an investor buys shares in a company from an existing shareholder. The person selling their shares is usually either a founder, company employee or another investor from a previous round.

The main difference here between a secondary and a fundraising round is that the buyers’ investment goes directly to the seller and not to the company who’s shares are for sale.

But what are the benefits of secondaries?

There are 3 main factors that drive secondaries:

-

- Discounts (buy-side):

When shares are sold on a secondary basis, they can be sold either as a standalone transaction or as part of the next funding round. In either circumstance, a discount is typically applied to the sell price attached to the shares. This provides an added incentive for the purchaser whilst allowing the seller of the shares to exit at at a premium to their initial capital contribution.

text - Access (buy-side)

The difference between investing in a secondary and a pre-seed or seed investment is usually brand recognition. During the smaller financing rounds, the company may still be trying to find product market fit and generate traction, whilst during secondaries, the company has proved itself since it’s smaller rounds and has built a much larger and recognisable brand. Due to the traction, it is often much harder for angel and smaller funds to obtain an allocation in their next round, which is subsequently where secondaries can come in — presenting the opportunity to invest in the company and buy some of the existing investors holdings.

text - Liquidity for existing shareholders (sell-side)

Lastly, and probably the main factor for sellers to sell their shares through secondaries is liquidity. With companies staying private for longer, realising investments are often much harder, with companies choosing multiple series and funding rounds instead of looking to IPO or exit through a sale. In addition to this, when investing in public companies, rebalancing your portfolio is a key strategy to risk management and secondaries can do the same in the private market investments. Whether it’s choosing to exit SEIS holdings after the mandatory 3 year holding period, or providing the ability for founders and employees who have all of their worth locked up in the company a means to take some diversify and take some risk of the table, providing the ability to for sellers to take some cash is a large driver behind secondaries.

- Discounts (buy-side):

Calculating valuations for secondaries

When it comes to determining valuations for secondaries it can depend on a few variables. For example, if your company has undergone a recent funding round you can use its valuation as a reference point in pricing your shares.

Just like buying secondhand, a slight discount is usually applied from the last valuation ie between 5 and 20%. However, in an extreme case the valuation can be higher than the last round if the company has experienced rapid growth and traction.

In either event, it’s the last valuation should be used as a base to determine the value of the shares at that date, and then you should use the information you have available to you to determine if you are open to pay a discount or a premium on the shares in questions.

For more information on valuations please look at our previous article on valuations.

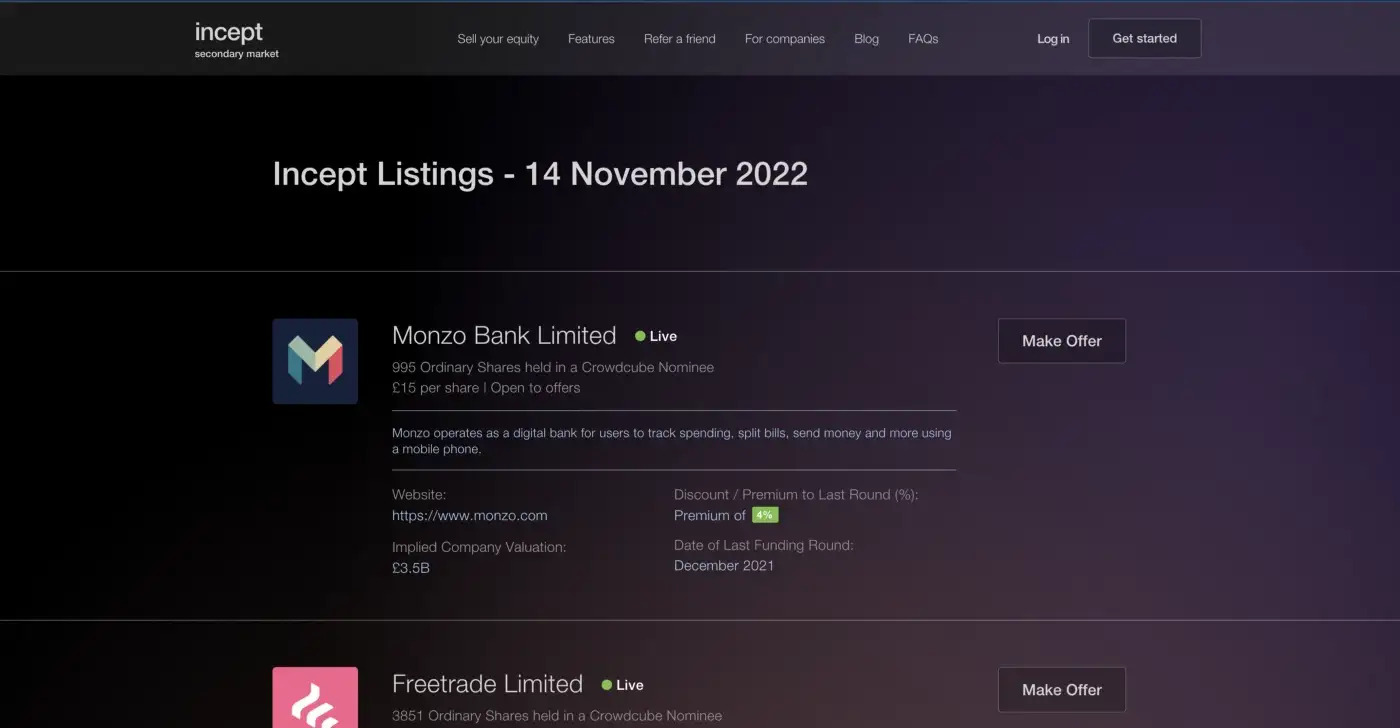

Incept secondary market

With Incept, we make the sale of private market shares accessible through a secondary market, allowing our users to realise their investments

as and when they want.

From crowdfunding investors to employees with share options and smaller funds, we handle the entire process from start to finish.

If you’re interested in selling some of your shares, you can begin the process here or you can have a look at the current shares on the incept platform by clicking signing up for early access here.