Firstly, here’s some good news: due diligence is something that we all do whether we realise it or not. From watching trailers before deciding on the best to series to binge on Netflix to, reading a menu / customer reviews before picking a new restaurant — these are all forms of due diligence, with the overall goal of learning more about a particular thing before making a final decision.

This ladies and gentlemen, is essentially what due diligence is about — a (sometimes) exciting and winding path, filled with many twists and turns that might just end with you finding a pot of gold along the way.

An Element of Luck

When it comes to investing in private companies, it’s quite difficult to calculate the ROI, or even if the company will be successful to begin with, and due diligence isn’t unfortunately, not a recipe for guaranteed success.

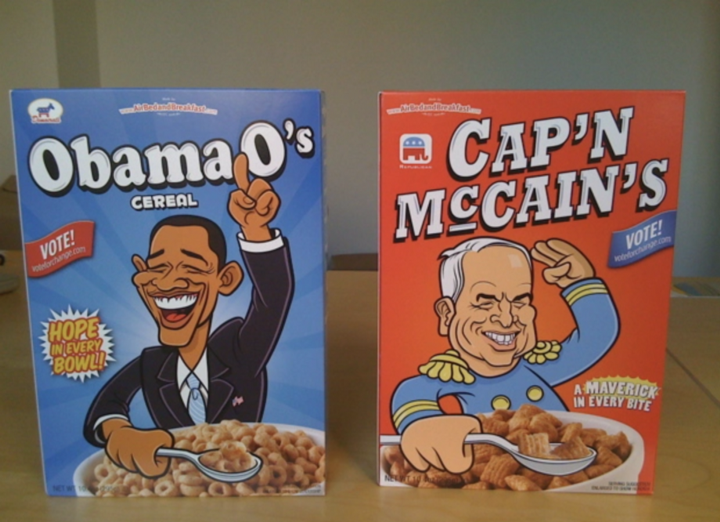

Brian Chesky, founder of AirBnB had to walk through several No’s from VC’s with in-depth experience in evaluating companies, and ended up getting it’s initial capital from selling election-themed cereal boxes. However, if anybody did decide to take the plunge an invest, they would have walked away with a 10% ownership of a company that is now valued at over $100,000,000,000.00, when a through due diligence review probably would have screamed “keep your cash firmly in your pocket”.

So Paasha, I hear you say — why can’t I go with my gut and invest in the next AirBnb? Well…whilst this is certainly an approach you can take, with stats showing that 50%-70% of all individual angel investments result in a loss of a capital, a lack of due diligence, can quickly start to look like aimless cross-fire gambling rather than strategic investing, and may very well end up with you loosing all your money in the search for the next big thing.

Experience is the best due diligence

Understanding the market of the companies you’re planning to invest in/having industry experience, allows you to make smarter decisions and help your Founder with their challenges by providing tangible value add.

I’m sure you’ve seen an episode of dragon’s den (or shark’s tank for our US friends) where the investors are asking a million and one questions about the founders, the team, their business, cash flows and their future plans. One thing you’ll notice is that the investors that ask the best questions and typically draw out the best information from a founder are the investors who have had experience in those sectors, and as such, know about things general to the sector like market size, competition, pain points, etc.

Additionally, it helps if you have a real passion for the industry you’re investing in as during the early stages, it’s very difficult to assess which companies would hit the ground running. Having a sustained interest means you’re there for the long run and are as invested in the wellbeing of the company as the founding team.

Having this insight into an industry can be super helpful as it allows you to see a larger picture than you ordinarily would do and make a more informed decision about the best idea’s and founders to invest in.

With this being said, diversifying your portfolio into different industries is a pretty important way to manage an already risky portfolio, so there will be times where you’ll need to make less informed decisions as an angel investor (especially when investing in innovative spaces). Here are some of things you can look at to aid your due diligence:

1) Does the company have its house in order?

There are a few admin questions that you can ask to sift out the most important checklist items, to summarise from The Angel Investment Network:

- Check out their cap table: who are the initial shareholders? What share classes do they have and does this affect your future dilution? What share price/class are they offering?

- Have they got their IP assignment registered correctly? How much ownership do the stakeholders have vs their development team

- What share price are they offering and what does this mean to existing shareholders?

- If they are incorporated in the UK and are eligible, do they have their Advance Assurance to provide you with a tax break post investment?

2) Are you backing the right founding team?

As early stage Uber investor and VC legend Jason Calacanis highlights, more often than not when you are investing at such an early stage in a company’s development, you are betting more on the founding team than the business idea in itself.

Alongside the UK’s Business Angel’s Association’s 3 Ps (people, passion and perseverance) ask yourself:

- On a basic level, can you see yourself getting along with the team for 3+ years? Is there a basic level of trust and dependency and more importantly, do they have the emotional capacity to win the trust of its potential customers?

- Does the team have existing members with the appropriate skillsets for a successful launch? If not, is this part of the hiring plan?

- Have you carried out extensive background checks on the founders? You can use references, LinkedIn and Companies House for this step

- How long have the founding team known each other and under what circumstance? Have they had experience resolving internal conflict?

- How dedicated financially are they to the success of the company? How much capital have they personally deployed into the developments so far?

3) How realistic is the market opportunity?

When assessing the Total Addressable Market, Serviceable Addressable Market, and Serviceable Obtainable Market, evaluate the following to assess whether the numbers are worthy enough to pursue:

- Has there been a justified demand for the solution the start-up is offering? How large can this demand grow to in the future?

- What does the route to market strategy look like in terms of timings and costs associated?

- Does the market have a lot of competitors or is the start-up carving out a new niche? If the former, what is it that truly differentiates the founding team from the other businesses and how will they outcompete? If the latter, what steps are being taken for an effective launch and establishment ie customer education?

- How happy would the customers be with the current service/product price? Does the pricing model need to be revisited and if not, what information has the team collected to justify it?

4) Down to the nitty gritty: the financials

Mitigating risk can be coined down to carrying out a deep dive into a company’s assets and liabilities. Here are a few things to keep in mind:

- How realistic are the company’s financial forecasts and projections? What kind of assumptions are these based off?

- How transparent is the company’s traction?

- how long will it be before the company is making a net profit, and how much capital is needs to be invested before this milestone?

- Previous vs future investments: has the company raised before? If so, what was the burn rate like and what milestones did they achieve with this capital? Is the company currently raising for enough runway to last them a year? What do future rounds and their equity dilution look like?

- Does the company have any exiting financial commitments ie debt repayments, convertible loan notes, payroll

- What does the company’s balance sheet look like? Are liabilities accounted for and what is the total realistic value of the company’s assets?

5) Legal due diligence deserves a whole separate article on its own

Laborious but most definitely worth it, legal due diligence is a step that you should never miss out when you’re sifting out a potential investment opportunity.

For now, here is a link to a fantastic checklist prepared by Tony Littner, Jon Gill and Sandy Finlayson for the UK Business Angels Association so that you can make sure that no legal DD step is left unturned.

You’ve finally made it to the end of our hefty due diligence checklist but you should know that the type of investigative questions that you may ask your start-ups really do vary with the types of industries and markets you’re looking to invest into.

We hope that you find the list above a useful starting point for your investment journey and wish you a successful scouting season 🏁!