How you can separate yourself from the rest of the cap table

Congratulations! You’re on your way to making your first investment in an early stage company as you finally caved in and succumbed to all the buzz coming from the start-up world.

You have a few ££££ just sitting in our bank account and you’re eager to put it to good use and help that friend who’s just started his own venture, or that colleague who’s been pitching to you for months.

A common misconception is that angel investing begins and ends with solely deploying capital to a company, sitting back and waiting for returns.

Whilst you could theoretically do this, it certainly isn’t the best strategy for the best returns or for the founder themselves.

In this article, I’ll be walking through just how you can add value as an angel investor (not just financially) so that both you and the company you invest in reap the best rewards.

Being a mentor

It is quite likely that the start-up that you’re looking to invest in is at the early stages of building their venture and it’s the first time they’re experiencing the hurdles they’re facing.

Being a founder involves wearing multiple hats, and by virtue of the job, some hats are going to be unfamiliar to the founder. As a result of this, founders may need your direction, advice and support in areas that you could hold some expertise in i.e. financial, legal, marketing, sales, etc.

Now whilst this might feel like hand holding to you, it could very well make all the difference in providing your founder with the confidence they need to execute their strategies in a timely manner.

To make these conversations as efficient as possible, once you have set out how you can help (and established that your help is needed), you can schedule bi-monthly/ monthly catch-ups where you can have frank conversations with how things are going, and where your skills can be deployed.

Being their best critic

Having someone to deliver all types of news without the bells and whistles is a gift that all early stage founders never knew they needed.

When it comes to constructive criticism, whilst you shouldn’t be one to shy away, you should also remember that the key to constructive criticism is to make it constructive. Any feedback given should allow the founder to develop a clearer picture as to a particular issue or challenge that you’ve noted and walk away with options to consider as a potential solution.

This is where all your industry and market experience comes in handy. To provide real value, you can carry out a top-down analysis on various aspects of the business within your expertise such as:

- User experience

- Go-to-market strategy

- Pricing model

- Customer acquisition strategy

- Unit economics

- Business model

For tips on delivering constructive criticism, you can check out “Positive feedback: the science of criticism that actually works” by

Being their first customer

You’ve invested your capital, time and resources to help get your founder off the ground and they’ve finally come back to you with their first MVP.

You now have the honour of being both their first users and biggest evangelist, providing feedback and sharing their product to the rest of your friends and family network.

All throughout the initial testing period, there are a few points of feedback you can ask yourself and note down to help the founding team perfect their product:

Here are some which Growth Mentor touches on in his article:

- Were your expectations about the product met, unmet, or exceeded?

- What is the greatest concern that you have about the product?

- Did the product help alleviate the problem you were looking to solve or enhance your current methods?

- How do you use the product?

- Do you feel the product is worth the cost?

- What feature could help make your experience better?

- How likely are you to recommend the product?

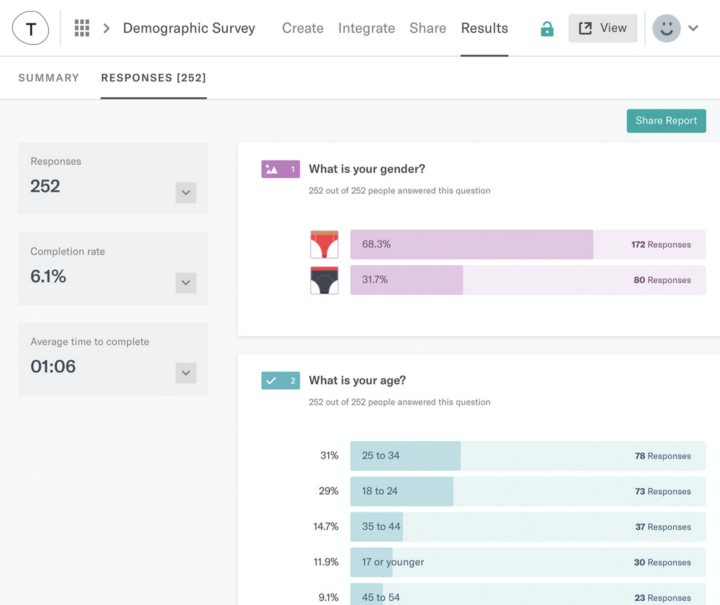

You can also point the founder to some helpful resources, like Typeform and Intercom, which are fantastic tools which can be used to collect feedback data.

Just ask!

Now this section might seem a little too obvious to you but you’d be surprised by how many investors fail to simply ask follow up questions with respect to certain areas of building that founders might find challenging.

If there is a particular hurdle you can predict being a little too high for your founder to jump over, it might be beneficial to point it out even before they come across it.

Alternatively, you can prompt founders to reveal areas that they may need help with by asking questions like:

- How will your customers find you?

- How healthy are your financials?

- What trends do you see in the market?

- What are your priorities over the x amount of weeks/months/ years?

- What do you expect from an investor besides money?

Introductions to growth stage VCs

After the first couple of months of your time being an angel investor, chances are you have probably seen a lot of amazing milestones that your founders have accomplished.

Like a proud parent, you’ve witnessed them battle the challenges of product development, finding their initial customers and outcompeting the market leaders in their space.

There might even be a time where they will be looking to raise their next round of funding, and chances are it will be for a much larger amount.

Now, you can definitely swoop in and secure more equity in the company if you are given the opportunity, however your network effects would provide the most value here.

Naturally, you may have have existing connections with other angels. To help your founders complete their next stage of funding, you can facilitate warm introductions to other investors who are looking for more growth stage investment opportunities or introduce them to other angel networks in the ecosystem.

You can even introduce your founders to other VC’s through platforms like Openscout, by landscape.vc — a platform developed by

to share exciting startups with your existing investor contacts, whilst also growing your network.

All in all, it’s a road filled with many twist and turns, that don’t seem to end, but the value add you provide as an investor can make all the difference in a venture’s success.

Ps. the podcast, Angel (hosted by jason Calacanis), is a fantastic resource which shares learnings from some of the most successful Angel investors in the world and acts as a nice complementary guide alongside your investing journey.